starting credit score at 19

Apply for tons of cards at once hoping one works. Your lender or insurer may use a different FICO Score than FICO Score 8 or another type of credit score altogether.

Sundayspotlight Tag Someone You Know That Needs This Information Mycreditreportiswrong Credit Creditrepair Cred Credit Karma Saving Money Weekly Saving

Youll need a credit history to get everything from personal loans to credit cards but also products like pay-monthly mobile phone contracts and utilities paid by direct debit.

. Still many people start building credit when theyre young even if it happens to be bad credit. Ignore your credit score until you need a. What credit score do you start with.

Work with your parents or a banker to only apply to cards that you might get. For example most FICO Credit Scores range from 300. When I checked his credit report I was shocked because his credit score was 820 which is about 50 points higher than my score.

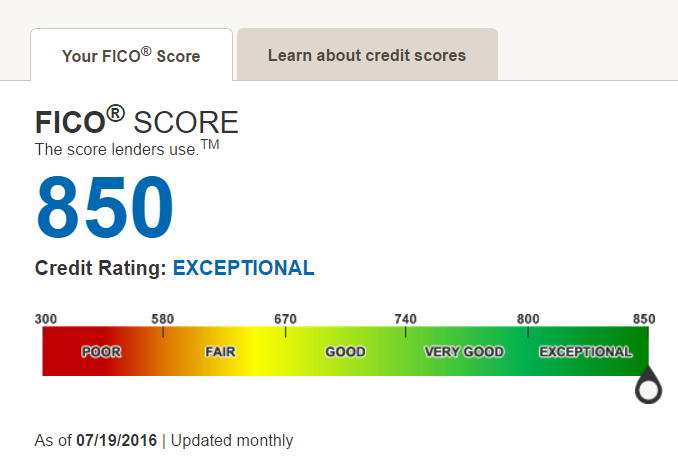

There are many different types of credit scores but the most popular is the FICO credit score. Credit score calculated based on FICO Score 8 model. Your basic information isnt reported until youve actually had credit such as a credit card loan etc in your name for at least 6 months.

Your credit score does not magically begin at any specific age such as 18 or 19. I have one credit card from my bank and paypal credit. However this doesnt mean that your credit score starts out at 0.

That means having a low credit score would add more than 6500 to the cost of financing a new car. Heres how you can build a great credit score even if youre starting right from scratch. Its unlikely to be that low either.

Those with the lowest credit scores received average terms of nearly 10 more months. Below the minimum criteria you will not have a credit score at all. Why start building credit before turning 18.

Your behavior sets the wheels in motion not your birthday. Some credit card companies also offer unsecured credit cards for those with no credit. The FICO credit score range is from 300-850.

Some may not see improved scores or approval odds. The Starting Credit Score Companies that focus on selling credit tradelines to customers also help to establish a high initial score. I own a rental property in a college town so I recently found myself running the credit score of a 19-year-old student who had applied to lease my place.

A good credit score can be the difference between getting approved for a new credit card or loan by a lender and getting rejected. A credit score is a three-digit number that represents how creditworthy you are. For those who want to know how to start credit building without someone else a secured credit card might be a good place to start.

They start low and you have to earn a higher score. Credit scores dont start high and you lose it by not making payments. But its highly unlikely your first credit score will be that low unless you start off with very poor credit habits.

Credit Score requirements are based on Money Under 30s own research of approval rates. If you are just starting out you dont have a credit history. For some lenders a credit score below 670 is considered subprime and would either lead to a denied application or the consumer being approved for less favorable terms.

When I got my first card I was in the low 500s. I got declined for a couple of things so I joined to see all my credit ratings for free experian equifax and call credit they all said it was low but good at the same time. Review of individuals who used specific methods to build credit As you can see from the chart above this is a great strategy to use especially if you are starting out with a fair credit scoreCredit Sesame members in this range saw their credit score jump nearly 80 points in just 18 months by using this strategy.

You might be surprised to learn we all start out with no credit score at all. Use your card for gas. The equations calculate your initial rating after your consumer report contains enough valid and current information to make a reliable prediction about future payment performance.

Rest assured that your first score wont be zero though as the most common credit-scoring models start at 300. Credit Score Requirements. After six months I would guess you would start somewhere between 600 - 700 on FICO models.

Once you begin to establish a credit history you might assume that your credit score will start at 300 the lowest possible FICO Score. How is my credit score compared to other 19 year olds. A credit score helps lenders evaluate your credit profile and influences the credit thats available to you including loan and credit card approvals interest rates credit limits and more.

Nor will your first credit score be the highest level under the two most commonly. A credit score is a three-digit number summarizing your credit risk based on your credit data. Ratings at the lowest end of the credit-score range reflect the most serious credit-score damage and its nearly impossible to get into that much trouble when youre just starting out.

Since credit scores range from 300. Each credit inquiry actually lowers your score. I used to use over 50 ututilization rate since i didnt know but have never made any late payments.

As you can tell younger consumers on average have lower credit scores while older consumers have higher credit scores. Hi I am 18 soon to be 19 and thought now would be a good time to start builidng my credit rating. Get a Starter Credit Card.

These tend to have low credit limits and may have high interest rates. However the starting credit score isnt zero. You want it to report because it shows youre using it and paying it off.

Check your credit score yearly. The only thing turning 18 does in terms of your credit score gives you the ability to open a line of credit in your own name you CAN start your credit score at 18 but its not automatic. Credit scores and credit reports are an important part of personal finance.

In other words this number tells lenders how likely you are to repay your loans and if youre a responsible borrower. There are 2 major reasons to start building credit as soon as possible though. Meeting the minimum score will give you the best chance to be approved for the credit card of your choice.

Decided to do my first credit score check and got 702 for Euifax and a 726 for TransUnion. Plus the average monthly new car payment was 544 for those with the lowest scores compared with 517 for those with the highest scores. Generation Z the generation of individuals born.

A FICO score can only be generated on a credit file with more than one trade line reported within the last six months and over six months old and the consumer must not be dead. How parents can give their kids a huge credit score. Let it report to your credit and pay it off on the due date.

3 Ways How To Improve Your Credit Score How To Improve Your Life Repor How To Improve Your Credit Score Improve Your Credit Score How To Improve Yourself Life

Schumer Who Thanks To Nerdwallet For This One Credit Card Statement Credit Card Infographic Paying Off Credit Cards

How To Raise Your Credit Score Fast Improve Your Credit Score Improve Credit Score Improve Credit

Good Arrow Indicator Ea What Is Credit Score Credit Score Forex

Ultimate 19 Finance Trade Services It Icons Presentation Templates Powerpoint Template Free Powerpoint

Ever Wondered If It Was Possible To Get A Perfect Credit Score Credit Score Personal Finance Budget Personal Finance Lessons

How To Build Your Credit Score In 2019 Credit Score Credit Score Building Credit Score Average Credit Score

Credit Improve Your Credit How To Improve Credit Scores Popular Pin Credit Cards Make Money Save Mo Improve Credit Score Improve Credit How To Fix Credit

Learn What A Credit Score Is How To Find Out Your Credit Score How You Can Improve Your Credit Credit Card Hacks Improve Your Credit Score What Is Credit Score

How Long Can Items Stay On Your Credit Reports Good Credit Credit Solutions Check Credit Score

How To Raise Your Credit Score 100 Points 5 Easy Steps Improve Credit Score Credit Score Improve Credit

How Can I Start Building My Credit History Improve Your Credit Score Credit Repair Credit Score

Striped Ribbed Shirt Credit Score Infographic Good Credit Score Improve Your Credit Score

Need A Little Wednesdaywisdom To Keep You Motivated When You Re Financially Stable Healthy You Can Live The Life You Want Start Do Improve Your Credit Score Credit Score Rebuilding

Log In Free Credit Score Free Credit Reports With Monitoring Credit Karma Credit Karma Credit Karma Free Credit Score Karma

30 Goals Before Age 30 Self Care Activities Life Routines Money Management Advice

What Are The Different Credit Score Ranges Credit Score Range Credit Score Good Credit Score

Tips To Improve Your Firm S Credit Rating Improve Credit Score Improve Credit Improve Your Credit Score

3 Ways How To Improve Your Credit Score How To Improve Your Life Repor How To Improve Your Credit Score Improve Your Credit Score How To Improve Yourself Life